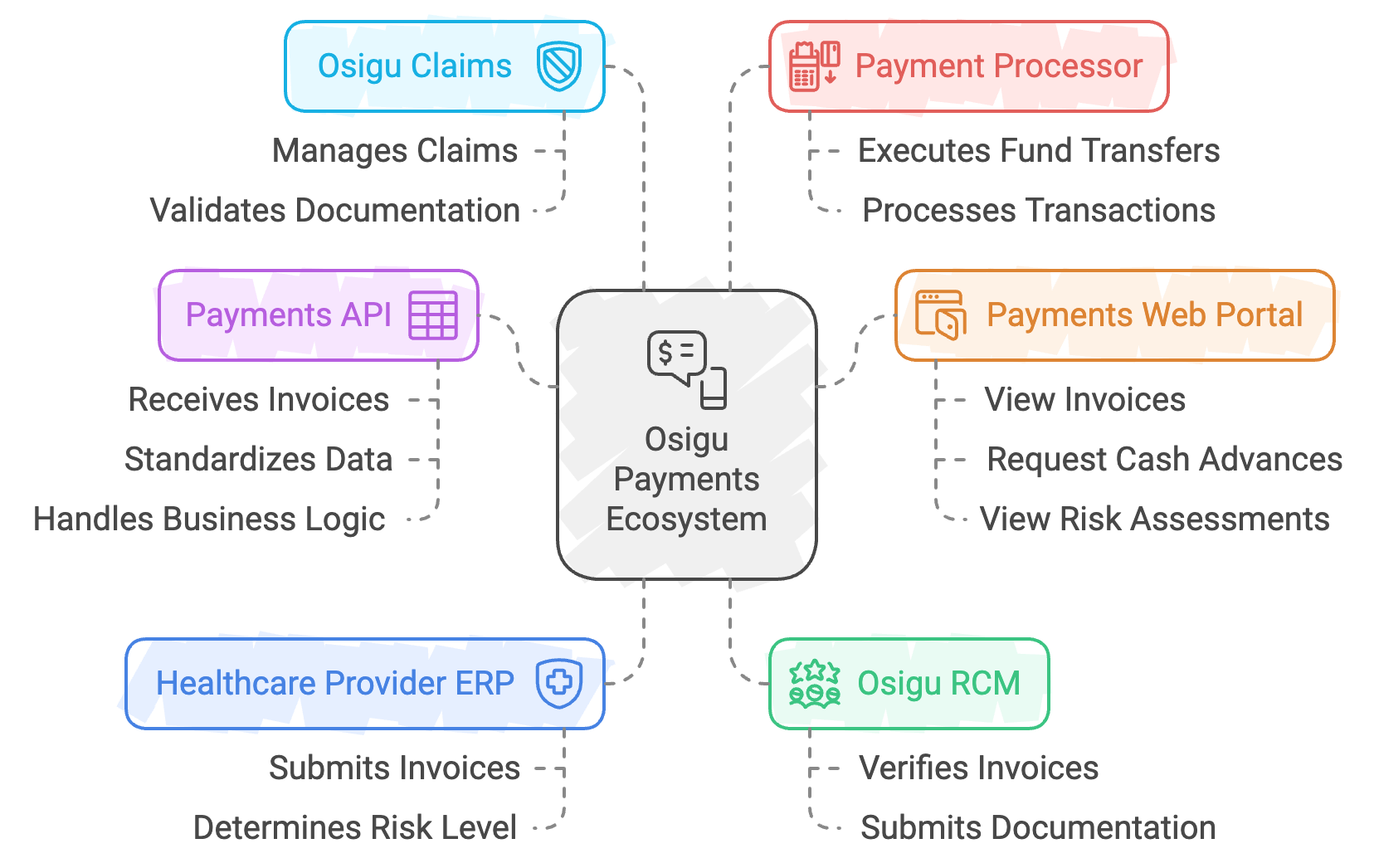

Overview of components

Osigu Payments is a financing platform designed to enhance liquidity and financial efficiency for healthcare providers and payers. Payments centralize accounts receivable and accounts payable information, allowing providers to request cash advances on their invoices and payers to offer early payment in exchange for a fee. The system’s architecture includes multiple components that interact to manage, analyze, and process invoices and payments.

This documentation outlines the core components and workflow of Osigu Payments, with integration details to streamline your setup.

Components

Osigu Payments integrates multiple components to manage, analyze, and process healthcare invoices and cash advances efficiently. The key components are:

1. ERP of the Healthcare Provider

The ERP of a healthcare provider is one of the primary data sources for Osigu Payments. Invoices and optional or mandatory additional information are extracted from the ERP. This extra data influences the risk level associated with an invoice, which affects both the advance percentage and fee. For example, an invoice lacking specific documentation may be deemed high-risk, reducing the available advance percentage and increasing the fee.

2. Osigu RCM (Revenue Cycle Management)

Osigu RCM, an external yet Osigu-integrated module, is another data source for Payments. Through RCM, invoices with additional information can be sent directly to Payments. These invoices are considered medium/low-risk because they are verified by Osigu’s processes, ensuring the account is structured correctly and has been submitted to the payer.

Info: Invoices from RCM have additional validation, meaning they are often processed with favorable terms due to lower perceived risk.

3. Osigu Claims

Osigu Claims manages authorization and claims for health services and products, providing invoices and supporting documentation. This source is considered low-risk, as Osigu Claims handles the process from eligibility checks to final approval, validating each step with automated, reliable, and accurate methods.

4. Osigu Payments API

This is Osigu Payments' core backend service. It is a centralized entry point for receiving invoices and additional information from various sources, including Provider ERP, RCM, and Claims. The Payments API standardizes data for further processing and handles all business logic, integrating with the Payments Web Portal and the Payment Processor.

Tip: Integrate with the Payments API to streamline invoice processing from any source, ensuring quick access to cash advances.

6. Payments Web Portal

The Payments Web Portal is an interface for providers and payers to manage their financial operations.

- For Providers: Providers can view received invoices, associated risk levels, available advance percentages, and fees. Providers can request cash advances and use the funds to make early payments to their suppliers.

- For Payers: Payers can view invoices submitted by each provider and offer early payment before the due date, deducting a fee in return.

7. Payment Processor

The Payment Processor is an asynchronous component that integrates with a payment partner to execute fund transfers. When a provider or payer requests an advance, a message with details of the invoices and the amounts to be transferred is sent to the processor. The processor ensures secure and accurate payment processing according to the rules defined in Payments.

Important: The Payment Processor handles both provider and payer cash advance requests, managing funds flow between all parties involved.

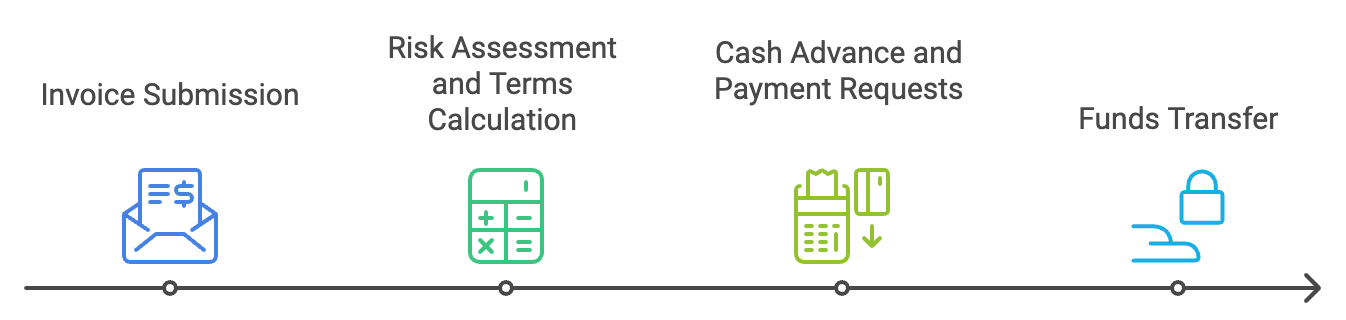

Data Flow Summary

-

Invoice Submission

Invoices are submitted from various sources (ERP, Osigu RCM, and Osigu Claims) via the Accounts Receivable API and integrated into Payments. -

Risk Assessment and Terms Calculation

The Payments API calculates risks, fees, and advance percentages based on the source and completeness of data. This information is then displayed in the Payments Web Portal, where providers and payers can make informed financial decisions. -

Cash Advance and Payment Requests

Providers and payers initiate requests for cash advances or early payments through the portal. Each request is assessed based on the predefined risk criteria and payment terms. -

Funds Transfer

Once a cash advance or early payment is requested, a message is sent to the Payment Processor. This component manages the transfer of funds to ensure secure and compliant processing.

Benefits of Osigu Payments

- Improved Cash Flow: Providers can access cash on invoices before the payment due date, improving liquidity.

- Flexible Payment Options: Payers can offer early payment, optimizing their relationships with providers.

- Risk-Managed Advances: Advanced risk assessment ensures that fees and advance percentages align with the quality of submitted information.

- Seamless Integration: Payments integrate with ERPs, Osigu RCM, and Claims for a unified data flow.

Updated 9 months ago